In recent years, the internet has become a hub for countless business opportunities, from e-commerce and investment platforms to digital marketing ventures. These past five years have witnessed a significant rise in Muslim fintech companies, the increased popularity of personal finance podcasts tailored for Muslim audiences, and the emergence of Muslim business gurus offering expertise in entrepreneurship and financial management. This trend reflects a growing demand for resources that address the unique financial challenges and ethical considerations faced by Muslims. While many of these opportunities are genuine and provide Muslims with halal ways to earn a living, an alarming number of scams specifically target the Muslim community. These scams exploit the desire for Sharia-compliant income streams. These scams often hide behind religious rhetoric. They use Islamic terminology to lure people in and make their schemes appear legitimate. There have been claims of embezzlement of funds by a well-known Western scholar, ponzi investment schemes by Muslim business “gurus”, cryptocurrency scams such as “Habibi Coin” and questionable property investment opportunities.

For Muslims, the pursuit of halal income isn’t just a financial concern; it’s a spiritual responsibility. Islam places significant emphasis on the source of one’s earnings, urging believers to avoid anything haram or ethically dubious. Given this, understanding how to distinguish between authentic business ventures and cleverly disguised scams is essential. In this article, we’ll explore why Muslims are particularly vulnerable to these scams, outline the most common types of business opportunities marketed to digital Muslims, and provide practical tips for recognising red flags.

Understanding the Appeal

For Muslims, earning a halal income is not merely a financial goal but a religious obligation deeply rooted in Islamic principles. Islam emphasises the importance of earning through lawful and ethical means, avoiding haram practices such as riba, gambling, and deception. This sense of responsibility drives many Muslims to seek business opportunities that align with their faith. These opportunities offer peace of mind and spiritual fulfilment alongside financial stability. However, this pursuit often comes with challenges. Conventional career paths or investment options may involve interest-based transactions or ambiguous practices that conflict with Islamic values. As a result, many Muslims are drawn to alternative ventures that promise compliance with Sharia principles. These include halal investments, halal franchise opportunities, or entrepreneurial activities. These opportunities appear to provide a way to earn a living while staying true to their faith. Thus making them particularly appealing to those who wish to combine financial success with spiritual fulfilment.

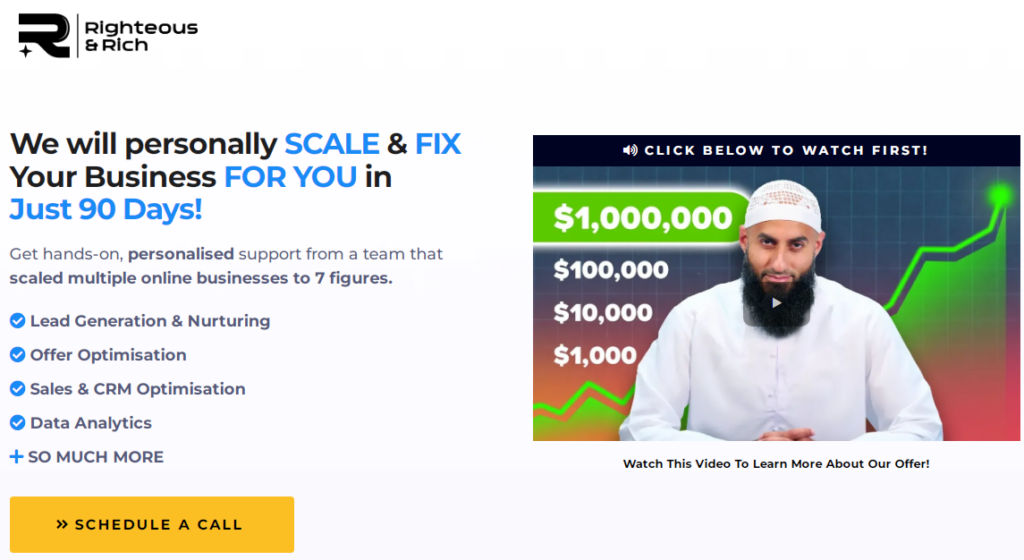

The digital era has transformed how people work and earn. There is an unprecedented access to remote work, e-commerce, and other digital business models. These platforms promise financial freedom and scalability, making them especially attractive to a growing demographic of tech-savvy Muslims. For instance, Imran ibn Mansur, widely known as Dawah Man, initially gained recognition for his energetic and often confrontational Islamic reminders targeted at youth and non-Muslims. Recently, he rebranded his YouTube channel from “Naseeha Sessions” to “Righteous and Rich“. The channel now focuses on advice about digital marketing and business models. This shift demonstrates the allure of digital entrepreneurship but also raises questions about balancing faith-driven content with commercial pursuits. Such examples highlight the broader trend of Muslims exploring digital opportunities while navigating community perceptions and ethical considerations.

From a business perspective, UK Muslims represent a unique consumer segment as they are considered a niche mass market. British Muslims generate at least £70 billion annually for the UK economy1. Religion and culture are significant influences on their consumer preferences and purchases. Thus there is a risk of exploitation due to their religious sentiments. Unfortunately, the popularity of online business models has made them a target for scammers. Fraudulent schemes often disguise themselves as halal or Sharia-compliant, taking advantage of the trust and aspirations of those seeking lawful income. This mix of genuine opportunity and potential danger underscores the need for vigilance. It also emphasises the need for informed decision-making when exploring online business ventures.

Common Business Opportunities Targeting Muslims

Business opportunities like dropshipping, affiliate marketing, and online coaching often appear to be halal business models because they do not inherently involve haram practices. These ventures are marketed as opportunities to work from home, achieve independence, and create sustainable income streams. Additionally, the global reach of online business allows Muslims to tap into a broader audience. This includes other Muslims seeking halal products and services, further enhancing the appeal of these ventures.

The most common business opportunities include:

- Dropshipping: Dropshipping has gained significant popularity among Muslims as an accessible way to start a business with minimal investment. In this model, entrepreneurs act as intermediaries, selling products through an online store without holding inventory. When a customer makes a purchase, the product is shipped directly from the supplier to the buyer.

- Islamic Investment platforms: A growing number of platforms offer Sharia-compliant investment opportunities, ranging from halal stock portfolios to real estate funds and crowdfunding for halal projects. These platforms appeal to Muslims looking to grow their wealth without engaging in interest-based or speculative investments.

- Forex and Cryptocurrency: Forex trading and cryptocurrency investments have also become prominent. While forex trading involves currency exchange and crypto deals with decentralised digital assets like Bitcoin, their permissibility in Islam is a matter of scholarly debate.

- Franchise Models and MLMs: Franchise models, such as halal food outlets or Islamic education centres, and multi-level marketing (MLM) schemes are often marketed as lucrative business opportunities.

- Affiliate Schemes: Affiliate schemes allow individuals to earn commissions by promoting products or services online. For Muslims, this model can be attractive as it offers flexibility and scalability with minimal financial risk.

By understanding these opportunities and their potential pitfalls, Muslims can make informed decisions. This enables them to pursue ventures that not only provide financial success but also align with their faith and values.

Recognising Red Flags in Potential Scams

1. Guaranteed High Returns

One of the most common red flags in fraudulent schemes is the promise of unrealistic profits. Scammers often lure victims by guaranteeing quick, effortless financial gains that far exceed typical market returns. For instance, they might claim returns of 50% or more in a short period, which is highly improbable in any legitimate business or investment. Islam encourages wealth-building through hard work and ethical means, and such exaggerated claims contradict the principles of steady and just earnings. Muslims should remember that no business is risk-free, and guarantees of extraordinary profits are often a sign of deceit.

2. Pressure Tactics and Urgency

Fraudsters frequently create a false sense of urgency to manipulate potential victims into acting impulsively. They might use phrases like “limited-time offer,” “spots are filling up fast,” or “act now or miss out on this blessing.” These tactics are designed to prevent individuals from taking the time to research the opportunity thoroughly. In Islamic tradition, patience and careful deliberation are encouraged, especially when it comes to financial matters. Muslims should be wary of any opportunity that pressures them into quick decisions without providing sufficient time for reflection or consultation.

3. Lack of Transparency

A hallmark of many scams is their lack of clear and transparent information about the business model, operations, or investment process. Scammers often use complex jargon, avoid providing detailed answers, or present vague explanations to confuse potential investors. This lack of clarity makes it difficult to evaluate whether the opportunity is genuinely halal or financially viable. Before engaging in any venture, Muslims should seek detailed information, including how profits are generated, who is running the operation, and whether the business has any form of legitimate registration or certification. Consulting a qualified Islamic finance expert can help verify compliance with Sharia principles.

4. Vague Religious Justifications

Many scams targeting Muslims misuse Islamic terminology and religious references to appear legitimate. They might cite Quranic verses about Allah blessing trade or hadith on wealth and prosperity to convince victims that their scheme is divinely supported. Some fraudsters use terms like “halal,” “Sharia-compliant,” or “Islamic investment” without providing any evidence or certification from reputable Islamic scholars. This exploitation of faith is particularly harmful as it preys on trust and spiritual values. Muslims should verify the religious claims of any business opportunity, checking for certification from recognised scholars or advisory boards and seeking advice from trusted sources within the community.

By staying vigilant and recognising these red flags, Muslims can better protect themselves from scams while pursuing halal and ethical ways to earn and invest.

Real-Life Digital Scams Case Studies*

Example 1: Aaqib Ahmed and Muslim Pioneer/Legacyprenuer

In November 2024, Aaqib Ahmed, founder of the Muslim Pioneer investment platform, was accused by several investors of operating a Ponzi scheme and mismanaging substantial funds. Ahmed reportedly promised high returns on investments, but some investors alleged that he used money from new clients to pay earlier ones, creating an illusion of success. A leaked video2 circulated online purportedly showed Ahmed admitting to debts of £5-10 million and acknowledging challenges in his business operations, while pledging to repay affected clients. Additionally, the Islamic preacher Zakir Naik reportedly stated on Huda TV that Ahmed used his images for marketing purposes without permission. This case highlights the devastating financial and emotional impact alleged scams can have on victims, especially when opportunities are marketed as Sharia-compliant. It underscores the need for due diligence and scepticism towards promises of guaranteed high returns.

Example 2: The Muslim Entrepreneur Network (MEN) and the Leverage Programme

The defunct Muslim Entrepreneur Network (MEN) launched its Leverage Programme in 2017, offering participants the opportunity to establish profitable businesses within a year. Around 1,400 individuals reportedly contributed between £225 and £25,000, inspired by the network’s emphasis on entrepreneurship and Islamic values. However, many participants later claimed that the promised ventures did not materialise, with some reporting financial losses and dissatisfaction. Complaints were filed with Action Fraud3, and co-founders Haroon Qureshi and Harun Rashid publicly disagreed over the programme’s management. Legal disputes involving the programme, including defamation claims involving ‘Rocky’ Mirza4, were also reported. Additionally, MEN’s alleged association with Aziz ‘Com’ Mirza5, a convicted scammer in Dubai, raised further concerns. While MEN initially appeared to offer a legitimate business opportunity, allegations of mismanagement and poor governance overshadowed its potential, leading to significant financial disappointment for many. This case underscores the importance of due diligence and transparent leadership, even in initiatives aimed at promoting halal entrepreneurship.

These examples demonstrate the fine line between genuine opportunities and deceptive schemes, reinforcing the importance of research, transparency, and professional consultation before engaging in any business venture.

*Disclaimer: The real-life examples shared in this article are based on publicly available information and aim to raise awareness about common scams and pitfalls in business opportunities targeting Muslims. They are not intended to defame or accuse any individuals or organisations but to educate readers on the importance of due diligence and caution. Readers are encouraged to verify facts independently and consult with qualified experts when making financial decisions.

Guidelines for Evaluating Business Opportunities

To avoid scams and ensure halal compliance, Muslims should follow key steps when evaluating business opportunities. First, verify claims of Sharia compliance by checking for certification from recognised Islamic finance institutions like AAOIFI or endorsements by qualified scholars. Next, thoroughly research the company, including its online presence, regulatory registration, track record, and the background of its founders. Consulting Islamic finance experts is also essential to assess whether the opportunity involves prohibited elements. Finally, seek peer reviews and community insights by joining forums or groups discussing similar ventures and weighing balanced feedback.

The article “Muslims, Scams and How to Avoid Them” from Islamic Finance Guru discusses the susceptibility of the Muslim community to financial scams. This vulnerability stems from strong communal ties, a tendency towards “get rich quick” schemes, and a general lack of financial literacy. It highlights emerging areas of concern, including Ponzi schemes, cryptocurrency frauds, fake AI impersonations, and overpriced high-ticket courses or coaching programs. The article emphasises the importance of financial education and vigilance in recognising and avoiding scams. It also warns against influencers who, while initially sincere, may slide into unethical practices. These include overpricing or misrepresenting their offerings, leading to potential financial harm within the community.

By following these steps, Muslims can make informed, ethical, and financially sound decisions. This approach is emphasised by Islamic finance expert Almir Colan.

Steps to Take if You’ve Been Scammed

- Reporting to Authorities – If you suspect that you’ve fallen victim to a scam, reporting it promptly can help authorities take action and potentially recover funds. Action Fraud is the UK’s national reporting centre for fraud and cybercrime.

- Seeking Financial or Legal Help – Recovering funds or navigating the aftermath of a scam often requires professional assistance.

- Protecting Yourself in the Future – After experiencing a scam, it’s important to take steps to safeguard against future risks.

Taking these steps not only helps you recover and move forward but also contributes to protecting others from falling victim to similar scams.

Promoting Ethical and Halal Business Practices

As a community, Muslims hold a collective responsibility to support businesses that align with Islamic ethics and promote transparency, fairness, and social benefit. By choosing to engage with enterprises that uphold halal practices, they ensure that their income and investments remain lawful. At the same, they contribute to the growth of a trustworthy halal economy. It is essential to seek out businesses with clear values, ethical supply chains, and transparent financial models. Supporting such enterprises helps build a robust ecosystem that prioritises faith-driven practices and reduces the influence of exploitative ventures.

Education serves as a powerful tool in protecting the Muslim community from falling victim to scams. Sharing knowledge and experiences empowers others to recognise red flags and make informed decisions. Initiating conversations about financial literacy and halal business practices within family, friends, and community circles is crucial. Mosques, community centres, and Islamic organisations can also play a significant role by hosting workshops, talks, or social media campaigns to raise awareness about scams and promote ethical entrepreneurship. Collectively, these efforts cultivate a culture of caution and accountability, shielding vulnerable individuals from financial harm.

In today’s fast-paced world, the allure of business opportunities promising financial freedom and success can often lead to rash decisions. This is especially true when such opportunities are marketed with religious undertones. This article examined the demand for halal income, the rise of online business opportunities, and the red flags to watch for in potential scams. Real-life examples, such as the cases of Aaqib Ahmed and the Muslim Entrepreneur Network, illustrate the devastating consequences of falling victim to fraudulent schemes. To navigate these challenges, Muslims are advised to adhere to guidelines like verifying Islamic finance certifications, conducting thorough research on companies, consulting trusted scholars, and seeking insights from peers. By remaining vigilant, supporting ethical businesses, and spreading awareness, the Muslim community can collectively safeguard itself while pursuing halal avenues of wealth.

Footnotes

- Press Release Hub. Groundbreaking Report Highlights the Economic Contribution of British Muslims to the UK’s Growth and Prosperity—and the Risk of Exodus. https://pressreleasehub.pa.media/article/groundbreaking-report-highlights-the-economic-contribution-of-british-muslims-to-the-uks-growth-and-prosperity-and-the-risk-of-exodus-27760.html. ↩︎

- 5Pillars. Muslim Investment Site Embroiled in Major Ponzi Scheme Scandal. Published November 15, 2024. https://5pillarsuk.com/2024/11/15/muslim-investment-site-embroiled-in-major-ponzi-scheme-scandal/ ↩︎

- Ham & High. Fraud Complaints over “Get-Rich-Quick” Scheme That Attracted Dozens of Investors in North London. https://www.hamhigh.co.uk/news/21133703.fraud-complaints-get-rich-quick-scheme-attracted-dozens-investors-north-london/ ↩︎

- VLex. Rafaqat Mirza v Adam Mirza & Ors. https://vlex.co.uk/vid/rafaqat-mirza-v-adam-86880030 ↩︎

- 5Pillars. Dubai-Based Conman “Com Mirza” Jailed for Fraud. Published June 24, 2020. https://5pillarsuk.com/2020/06/24/dubai-based-conman-com-mirza-jailed-for-fraud/ ↩︎